do you pay property taxes on a leased car

You can pay property taxes through the mail by telephone the internet onsite kiosk or by using the convenient dropbox located outside the Tax Collectors Office. In Virginia you pay full sales tax up front and receive no sales tax credit for your trade-in vehicle.

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips

Documentation Fee Tag Title Registration and License Fees.

. We accept electronic check as well as credit and debit card payments through the Internet for ALL types of taxes including vehicle taxes. In most states both car purchases and leases are subject to sales tax. Does that mean you have to pay property tax on a leased vehicle.

Personal Property Taxes Some states levy ad valorem taxes based on the value of property you own. When you rent a car the dealer always retains ownership. Leased vehicles produce income for the leasing company and are in turn taxable to the leasing company.

You pay personal property taxes on the vehicle unless. Vehicle value is taken into account by the personal property tax. To claim use tax when acquiring or utilizing leasing tangible personal property in this State lessees are responsible not only for paying use tax but for paying West Virginia consumer sales and.

If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. In many leasing contracts companies require their lessees to reimburse them for taxes assessed on the vehicles. Missouri collects a 4225 state sales tax rate on the purchase of all vehicles.

Lease agreements state how personal. Do you pay taxes on a leased car. When you lease a car the dealer still maintains ownership.

Are There Any Exemptions. Most states roll the sales tax into the monthly payment of the car lease though a few states require that all the sales tax for all your lease payments be paid upfront. You must indicate the deductions in Schedule A to make this depreciation.

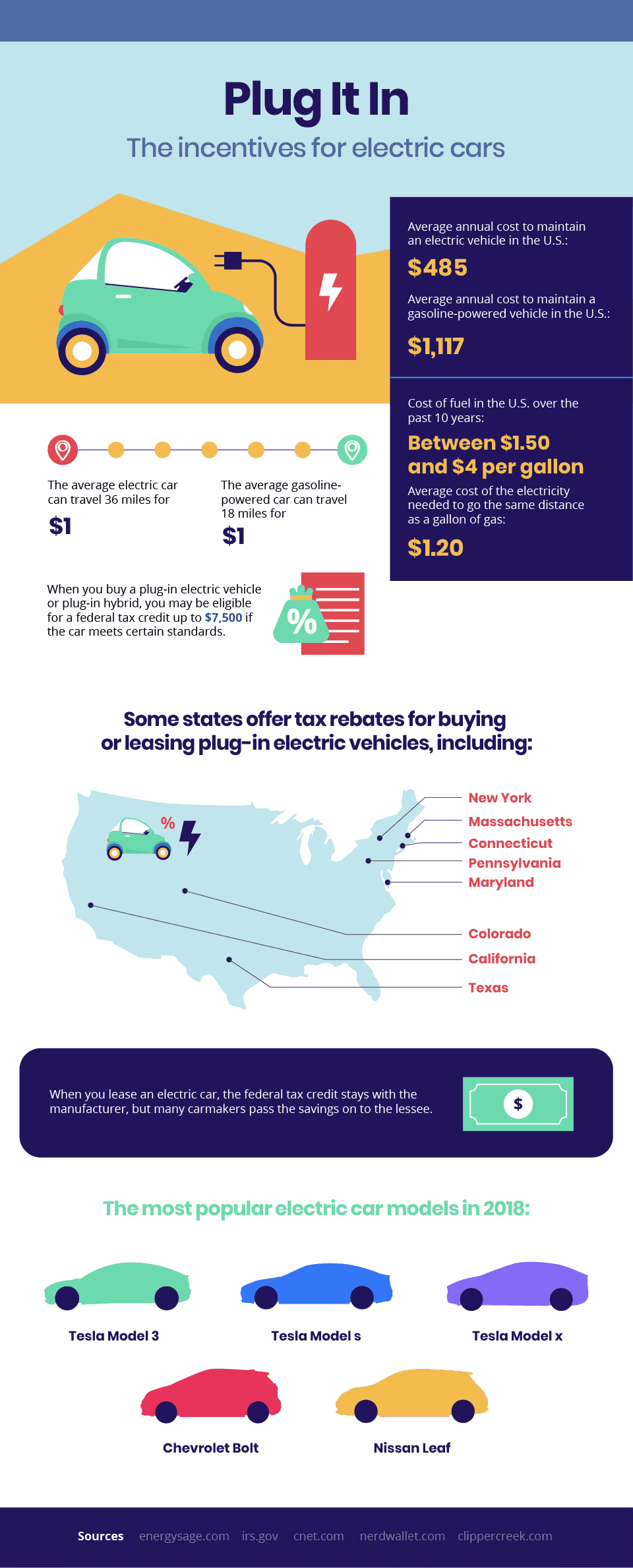

You may have pay taxes on a leased car depending on your state. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. Tax deductions on leased cars When paying a sales tax on your leased car you can take tax deductions from our federal income tax.

In most states you will be charged sales tax on any down payment you provide. Most leasing companies though pass on the taxes to lessees. You are usually responsible for paying the personal wealth tax applicable either to the owner or directly to the tax authorities.

Some states have a personal property tax on rented vehicles. The leasing company is generally billed for personal property taxes on all vehicles it owned on January 1. In car leasing how the sales tax is calculated and when it.

VAT-registered companies can reclaim up to 100 of the tax on vehicle payments on a business lease and on any maintenance package chosen. Depending on the county in which you live you may also pay a personal property tax that strangely is billed to you twice a year through your lease finance company. In most cases youll have to pay property taxes on your leased car each year that you have it.

After receiving an estimate of his municipal property taxes Sergienko was informed by tax collector Enfield that his leased Honda would be taxed. A leasing agreement and state statutes govern when personal property taxes must be paid on your leased vehicle and when it needs to be paid. It all depends on the lease that the dealer offers.

Leased Vehicles for Personal Use. Do You Pay Personal Property Tax On Leased Vehicles In West Virginia. Just as in a regular car purchase you will have to pay the dealer and state licensing fees.

This could include a car which in most households is a relatively valuable property. Some leased vehicles may qualify for Personal Property Tax Relief as provided in 581-3523 etseq. Please let us know if you have any further questions we will do our best to assist you View solution in original post 0 Reply 8 Replies JulieM New Member.

The monthly rental payments will include this additional cost which will be spread across your contract. The monthly rental payments will include this additional cost which will be spread across your contract. If the lease agreement states that you are responsible for these taxes you will receive an invoice from the dealer.

You can calculate Missouri sales tax on a car by multiplying the purchase price of the vehicle by the Missouri state sales tax rate of 4225. Vehicles leased to a person versus a business and. You may take a personal property tax deduction for the applicable amount varies by state for any vehicle you pay this tax for.

They pay the personal property taxes on the vehicle unless otherwise stated in your lease contract. In all cases the tax advisor charges the taxes to the dealer and the dealer pays. In New York Minnesota and Ohio you pay tax up-front on the sum of lease payments see New York Car Leasing and Ohio Car Leasing for more details.

However if you rent you are not the rightful owner and you cannot be responsible. The amount of property taxes youll owe will depend on the state where you live and the value of your vehicle. Vehicles leased to a person versus a business and used predominantly for non-business purposes may qualify for car tax relief.

The vehicle can be leased financed or purchased outright. Some leases do require a down payment - usually between 1500 and 5000. For example in Alexandria Virginia a car tax is 5 per 100 of the estimated value while in Fairfax County the assessment is 457 per 100.

If you pay personal property tax on a leased vehicle you. The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be levied by the state each year. It all depends on the lease that the dealer offers.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Leasing A Car Through Your Business In Canada Loans Canada

Is It Better To Buy Or Lease A Car Taxact Blog

Top 5 Hidden Issues Facing California Retail Leasing In 2020 Sacramento Business Journal

Is It Better To Lease Or Buy A Car For A Business In Canada

Financing Equipment Lease Tax Benefits In Canada Filing Taxes

Company Cars Should You Buy Or Lease Dmcl

Car Accidents With Leased Cars Adam Kutner Attorneys

Is It Better To Lease Or Buy A Car For A Business In Canada

/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

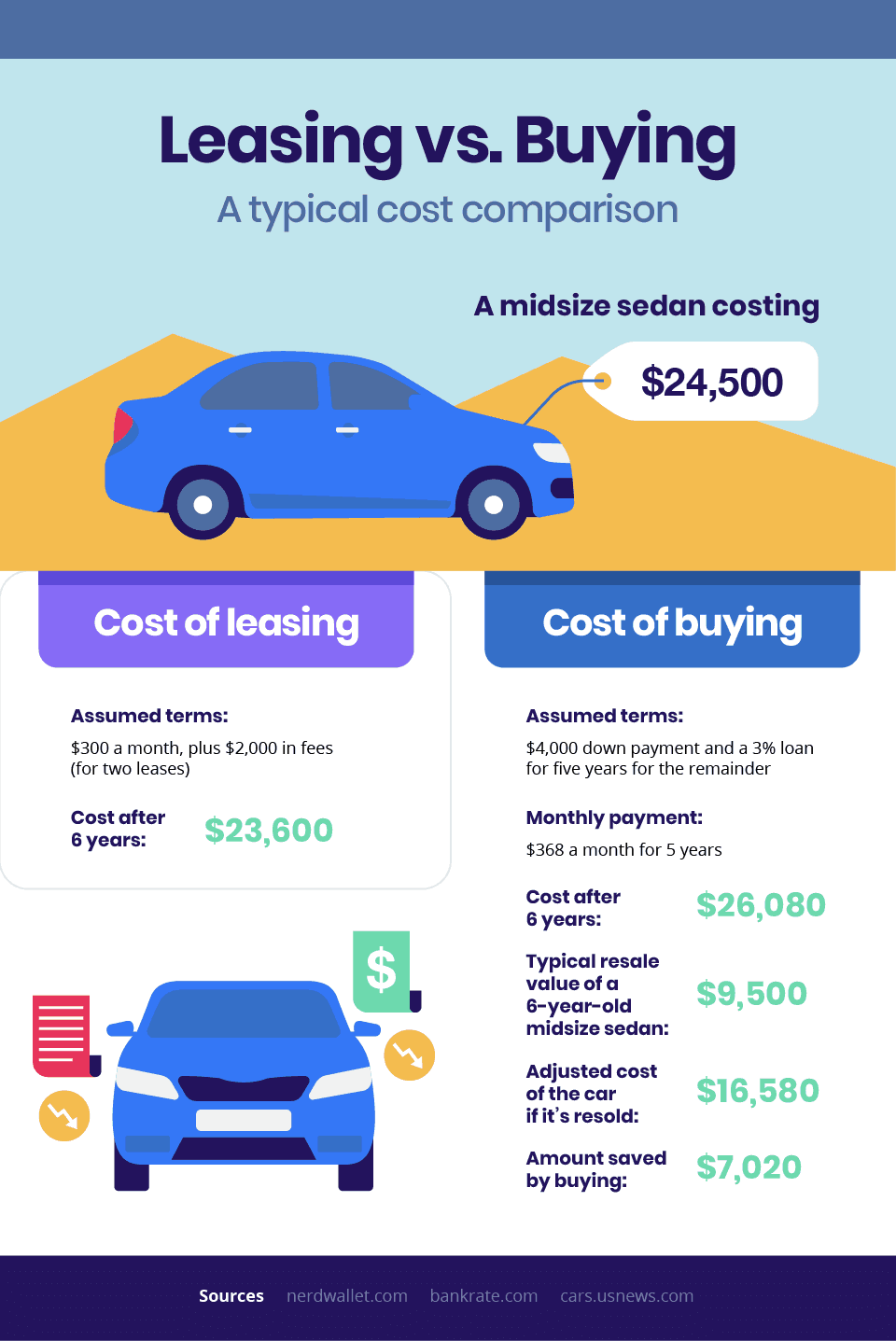

Buying Vs Leasing A Car Pros And Cons Of Each

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Can You Trade In A Car That S Still On A Lease Here S How Shift

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Is It Advantageous To Think Of Leasing Your Commercial Real Estate Commercial Property Commercial Real Estate Commercial

Just Leased Lease Real Estate Search Property For Rent

Is It Better To Buy Or Lease A Car Taxact Blog

Should You Lease Or Buy A Car Here Are Several Things To Consider